-Advertisement-

Venture capital giant Sequoia Capital reportedly downsized its cryptocurrency fund from $585 million to $200 million, amid a liquidity crunch and a pivot away toward smaller crypto players.

According to a July 27 Wall Street Journal report, the tech-focused VC firm told investors in March it would reduce its Sequoia Crypto Fund — along with its ecosystem fund — to better reflect changed market conditions.

Sequoia Capital curbed crypto investments by a hefty 65% , opting for a nurturing stance on startups. Not a volatile market apathy, but strategic cognition, folks! #CryptoInvestments $BTChttps://t.co/hfsAAd8jeV pic.twitter.com/8JvtyShg0n

— Chain Review (@Chain_Review) July 27, 2023

The cryptocurrency fund will now focus more on backing early-stage startups, given the recent crypto industry turmoil that took away many of the opportunities to back larger companies.

Another motive behind the cuts is to lower the capital threshold and thus the barrier to entry for investors to partake in Sequoia’s fund offerings, according to the sources.

“We made these changes to sharpen our focus on seed-stage opportunities and to provide liquidity to our limited partners,” Sequoia reportedly said in remarks to the Financial Times. The firm added it had returned more than $15 billion to investors over the past three years.

The firm’s cryptocurrency fund launched in February 2022, when the market cap of the cryptocurrency market was 39.1% down from its all-time high of $3 trillion in November 2021.

One of the firm’s toughest blows in recent times was its $214 million investment into the now-bankrupt FTX, which the firm later marked down to $0.

Sequoia Capital’s $214M #FTX stake marked down to $0 ⚰️ pic.twitter.com/RHQJaRq1dL

— CryptoSavingExpert ® (@CryptoSavingExp) November 10, 2022

Cointelegraph reached out to Sequoia Capital for comment but did not receive an immediate response.

Related: Crypto VCs share lessons on startup success at EthCC

Sequoia’s reported move is reflective of a broader trend among venture capital firms that are choosing to downsize their cryptocurrency bets.

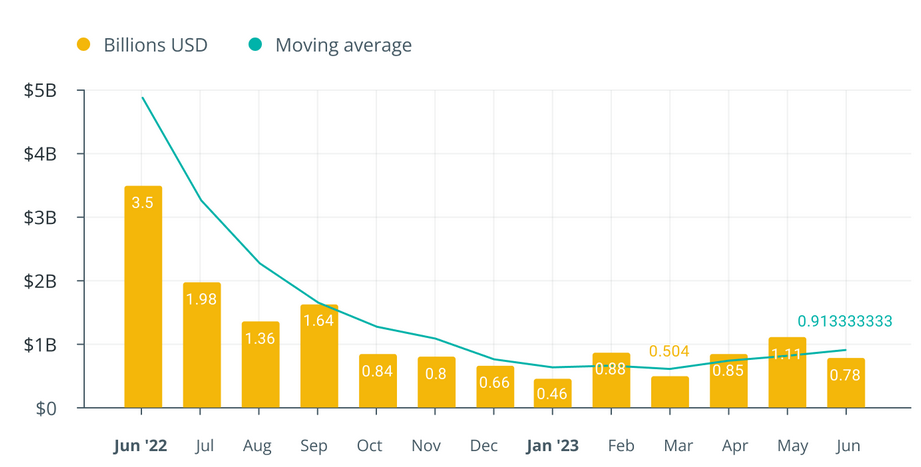

Venture capital investments fell 29.7% in June, with $779.32 million raised across 62 separate deals, according to data from the Cointelegraph Research Venture Capital Database.

Venture capital inflows have fallen 77.7% from June 2023 compared to June 2022.

However not every VC firm is reducing its cryptocurrency portfolio.

Polychain Capital and Coinfund recently raised $200 million and $152 million for respective investment and seed funds earlier this month.

Magazine: The secret of pitching to male VCs: Helping female crypto founders blast off

Source: COIN TELEGRAPH